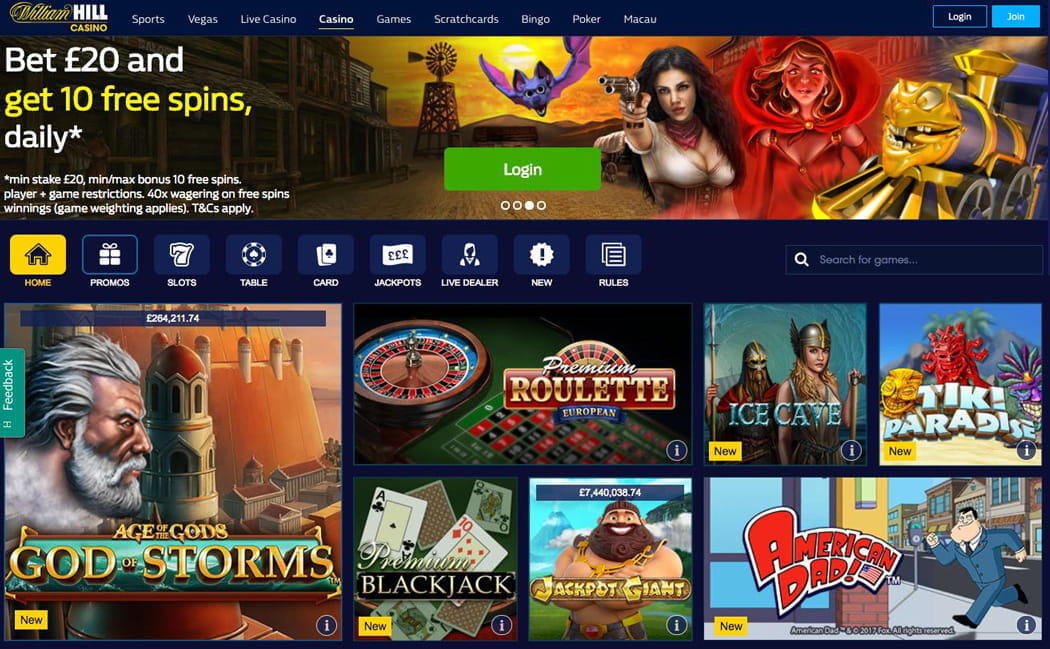

William Hill Casino Usa

William Hill’s exclusive sports betting rights across retail and mobile carry forward to the acquired company. If completed, Eldorado will be, by far, the largest owner and operator of US gaming assets with a combined portfolio of 60 casinos in 16 states and William Hill will have the greatest secured market access, of any sportsbook operator. London (CNN Business) Caesars Entertainment is in talks to buy William Hill in a deal that would value the British bookmaker at £2.9 billion ($3.7 billion) and underscore the size of the. Shareholders of William Hill PLC Vote to Approve Caesars Entertainment, Inc. Recommended Cash Acquisition. Caesars Entertainment, Inc., (NASDAQ: CZR) ('Caesars,' 'CZR,' 'CEI' or 'the Company').

Marketplace

In May 2018, the Supreme Court of the United States overturned the Professional and Amateur Sports Protection Act (PAPSA). This has transformed the legal sports betting landscape in the US and provided William Hill with an excellent opportunity to expand its global footprint.

Americans are passionate about sport, watching over 2 trillion minutes of sport across more than 11,000 live events each year1 . Many of those fans use betting on sports to enhance their engagement with and enjoyment of the match or race and, since PASPA was overturned, that is now a legitimate exercise in a growing number of states. Prior to PASPA, wagering through the illegal sports betting market in the US was estimated to be nearly US$200bn2 . In 2019, we believe fewer than 5% of wagers have been placed legally.

During the course of the past 20 months, considerable progress has been made to legislate and regulate on a state-by-state basis. By December 2019, 14 states had legalised and regulated sports betting. We are encouraged by the momentum in the number of states regulating sports betting. We are increasingly confident of the potential size of the market and see it falling comfortably within a US$5bn to US$19bn range within the first five years post PASPA. Nonetheless, the market is unlikely to mature for at least a decade.

Regulation is evolving on a state-by-state basis creating a complex landscape for operators to navigate and generating real barriers to entry in the form of market access, capital requirements, licensing and digital capability. Regulation by state typically follows one of three operating models, land-based only, land-based plus ‘tethered mobile’ (where a mobile or online account must first be opened by a customer in a licensed location) or land-based plus remote access (where a mobile or online account can be undertaken remotely, as in the UK). However, land-based wagering is typically only permitted at casinos and in some cases racetracks, while digital licences are typically limited in number and tethered to a land-based licensee. There are also states where there is a single sports betting licence, typically held by the local state lottery.

Strategy

Our strategic goal is to be a market leader and grow a US business of scale. For a US sports betting operator, there are a number of key components to ensure success: market access through partnerships, a flexible operating model, including software that can be released quickly and cater for different regulations, routes to market and brands, and operational excellence in different combinations of retail and mobile. The capability to provide a service model, such as for a state lottery, will ensure the broadest possible coverage. Finally, a recognisable brand and effective marketing partnerships are essential to delivering a business of scale in the long term.

Delivering the strategic objective

Market access is the critical starting point for success in US sports betting, as state access is predominantly controlled by land-based casinos, racetracks and state lotteries. It is our intention to enter every US state we can, offering retail and mobile sports betting where permitted by the law in each state.

We have been taking legal sports wagers in the US since 2012 when William Hill US was created from the combination of three small acquisitions. During that time, our growing team of local operators has demonstrated a meaningful competitive advantage, negotiating the regulatory, licensing and partnership landscape, to create a business with unmatched market access, secured in 24 states covering a potential accessible population of over 200 million people.

Since entering the market in 2012, the Nevada business has grown rapidly, providing sports betting at 114 locations, often at small venues away from Las Vegas. The Nevada business is digitally led, with 69% of all betting carried out via online channels and 31% through retail, giving us a market share in Nevada based on gross revenue of 32%. In 2020, pending the completion of the Eldorado-Caesars merger and our previously announced proposed acquisition of CG Technology, more commonly known as Cantor, we will further expand our Nevada position, adding 15 locations. Many of these locations are on the Las Vegas Strip, providing William Hill a leading sports book presence in this iconic location for the first time.

Since PASPA was overturned, we have been investing in people, technology and partnerships to enable the business to take advantage of the new regulatory environment.

William Hill Casinos

In January 2019, we entered a partnership with Eldorado to be their exclusive sports book provider, sharing in all economics related to sports betting. Eldorado is a leading casino entertainment company in the US, currently owning or operating 23 properties in 11 states and a loyalty club with c10 million members. Under the terms of the deal, Eldorado received a 20% stake in William Hill US.

In June 2019, Eldorado announced a proposed acquisition of Caesars. William Hill’s exclusive sports betting rights across retail and mobile carry forward to the acquired company. If completed, Eldorado will be, by far, the largest owner and operator of US gaming assets with a combined portfolio of 60 casinos in 16 states and William Hill will have the greatest secured market access, of any sportsbook operator.

In October 2019, we secured access to Washington D.C. through an exclusive partnership with Monumental Sports and Entertainment, one of America’s largest sports and entertainment companies, to operate a sports book at the Capital One Arena. This sports book, due to open later in 2020, will be the first in a downtown metropolitan area of a major US city outside Nevada.

During 2019, we continued to build out our local team and operating model with a focus on flexibility and scalability. We opened a new digital office in New Jersey, expanded our operations in Las Vegas and launched our new, purpose-built digital platform ahead of the 2019 NFL season.

Aligned with the Group’s intention to move towards a modular digital architecture, using best-in-class components, our proprietary US technology platform provides an efficient, differentiated and scalable product. The platform is already live in New Jersey and is ready to be deployed more broadly as states regulate across the country. Over time, the platform will service all products, retail, online and mobile, while the front end sportsbook experience has been tailored to US customers for use in B2B, B2C and white label operating environments.

Our tailored US product is managed and delivered by the most experienced sports betting team in the US today. Joe Asher has been CEO of William Hill US since 2012, having founded the Brandywine Bookmaking LLC in 2008 which formed the foundation of William Hill US.

As we grow the business we are building out a scalable and efficient marketing capability, enabling us to optimise our return on marketing spend. In addition we have partnered with CBS Sports, giving us a fully integrated, exclusive presence on a leading media and digital platform. CBS Sports is the number two digital US sports brand with over 80 million users per month and one of the largest fantasy platforms. This partnership will drive highly efficient customer acquisition and is another major step forward in our US expansion.

William Hill Casino Nj

1. Fox Custom Study, 2017.

2. H2GC.

The NFL has long been and will long be the center of the legalized sports betting universe. Even in a year with special scheduling (the NBA Finals in October, the Masters in November, etc.), the NFL still captures the spotlight.

This past week, though, the sports betting stage was set for massive deals, big revenue reports and an offshore operator looking to do right.

The latter topic is a lesson that by no means comes free, but more on that in a minute.

William Hill Casino Vegas

On to the Rewind:

Caesars agrees to purchase William Hill

Famed international legalized sports betting provider William Hill has new ownership.

Caesars has agreed to purchase the bookmaker for a whopping $3.7 billion in cash, a deal that is expected to close in the second half of 2021.

The two parties already share a US sports betting partnership, of course. This acquisition, though, allows Caesars to help the partnership reach its maximum potential. The combined sports betting and iGaming vertical could generate up to $700 million in pro forma net revenue in the 2021 fiscal year.

To boot, Caesars could make a run at William Hill’s international assets, such as its gaming business overseas.

Naturally, Caesars can create a shared wallet for its sports betting and online casino customers while cross-selling its rewards program to 60 million customers. On top of it all, it gives Caesars access to markets it didn’t otherwise have.

5Dimes reaches illegal gambling operations settlement

It appears 5Dimes is ready to walk the straight and narrow. But it certainly cost the company a few bucks.

An investigation into illegal US sports betting operations, money laundering and wire fraud led 5Dimes to reach a $46.8 million settlement with the US Department of Justice.

As part of a settlement with the US Attorney’s Office Eastern District of Pennsylvania, 5D Holdings and owner LauraVarela — widow of Sean “Tony” Creighton, who was found dead in Costa Rica after he was kidnapped and murdered in September 2018 — will forfeit the illegally obtained gambling proceeds via 5Dimes’ offshore operations in Costa Rica.

According to a lengthy list of criminal activities laid out in the settlement, 5Dimes began accepting wagers and making payouts in 2011 and transferred nearly $47 million in proceeds “to attempt to hide the nature, location, source and control of the funds.”

The company has made known its intention to enter the regulated US sports betting market once this investigation came to an end. No doubt, though, state regulators might hesitate to provide it an entrance.

That said, 5Dimes has already incorporated 5D Americas LLC in Delaware, allowing Varela the “use of her assets or the assets of the 5Dimes brand to explore future options, including, but not limited to, reconstituting the 5Dimes brand to be licensed to conduct legal, regulated gaming activities in the US and internationally.”

According to Jeff Ifrah, Varela’s attorney, 5Dimes will now attempt to gain a legal operating license in New Jersey.

Post-PASPA betting revenue is now over $25 billion

Just over two years have passed since the US Supreme Court repealed the Professional and Sports Protection Act. Since then, legalized sports betting has boomed.

How much? Well, thanks to the latest report from Nevada, bettors in America have wagered more than $25 billion since PASPA fell in May 2018.

For decades, Nevada has been the only state in which bettors could legally place wagers in the United States. Now, with $475 million wagered there in August, the Silver State has pushed the regulated US total handle past the $25 billion mark.

While New Jersey took over as the legal sports betting king in August, Nevada has driven the post-PASPA totals. Since the act went down in spring 2018, Nevada bettors have wagered over $10 billion, generating more than $600 million in revenue. This is in comparison with New Jersey’s totals of $7.7 billion in handle and $532 million in revenue.

William Hill Casino Login

Only two other states have exceeded $1 billion in post-PASPA handle: Pennsylvania, with $2.7 billion, and Indiana, with over $1 billion.